Introduction to Medicare

If you’re approaching the age of 65 or have a disability, you might be wondering about Medicare. Medicare is a federal health insurance program that provides coverage to individuals over the age of 65, as well as those with certain disabilities. In this article, we’ll take a closer look at the different parts of Medicare, the costs associated with each part, and the key enrollment periods you need to know about.

Different Parts of Medicare

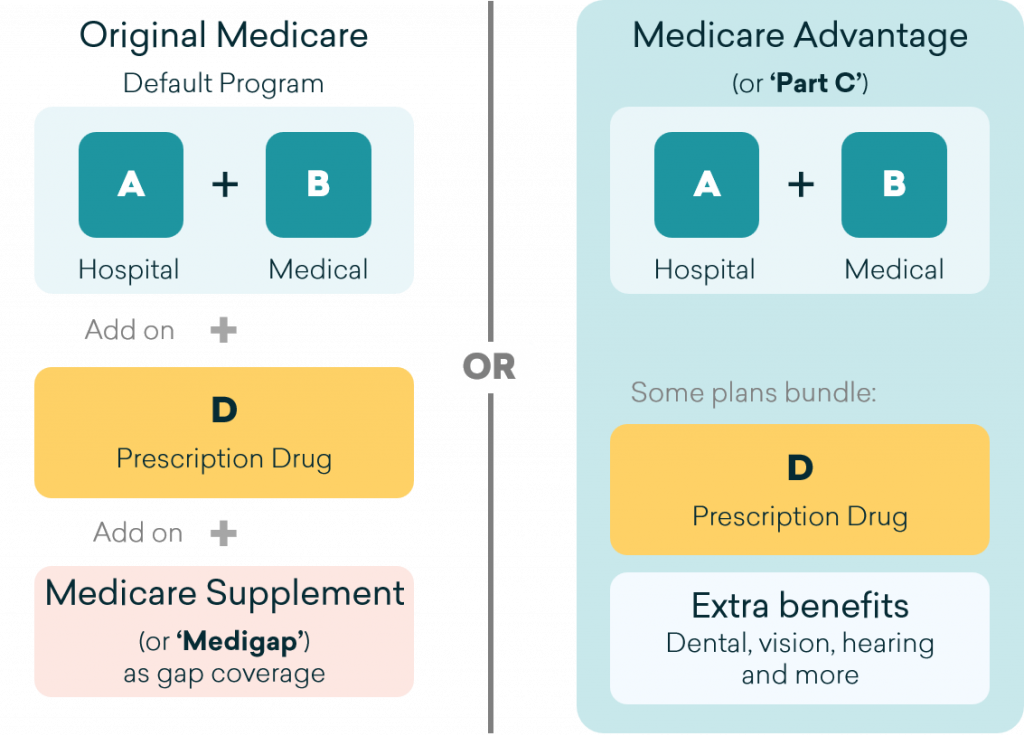

Medicare has four different parts: Part A, Part B, Part C, and Part D.

- Part A covers inpatient hospital care, skilled nursing facilities, hospice care, and home health care

- Part B covers doctor visits, outpatient care, preventive services, and medical equipment

- Part C also known as Medicare Advantage, is a combination of Part A and Part B, and may also include additional benefits like dental, vision, and hearing. Part C plans are considered a complete ”alternate” to Original Medicare and can only purchasable through private insurance compaioes

- Part D covers prescription drugs and can only be purchased through private insurance companies

Original Medicare Part A & B Cost for Dummies

Part A is typically premium free if you or your spouse have paid Medicare taxes while working for at least 10 years. There are additional costs such as deductibles and copays when you use Part A services.

Part B comes with a monthly premium, and you’ll also have to pay deductibles, copays, and coinsurances. The Part B premium is updated each year alongside the annual Part B deductible. After you meet your deductible, you’ll typically pay 20% of the Medicare-approved amount for most services.

You may also have to pay a Part B income-related adjustment amount if you income is higher than certain thresholds

Medicare Part D Cost

Medicare Part D also comes with a monthly premium, deductibles, copays, and coinsurances. The specific costs will vary depending on the plan you choose, as well as the medications you need. It’s important to carefully review your options and choose a plan that meets your needs and budget.

The Medicare part D premium depends on the plan you choose. As of now, the monthly Part D premium typically ranges from $6 to $111. The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43, based on current enrollments.

Medicare Enrollment Periods for Dummies

There are several key enrollment periods to be aware of when it comes to Medicare:

- Initial Enrollment Period (IEP): is the 7-month period starting 3 months before the month of your 65th birthday, during which you can enroll in Medicare Parts A and B. If you miss this enrollment period, you may face penalties.

- General Enrollment Period (GEP): is between January 1st to March 31st each year. If you miss your Initial Enrollment Period, you can sign up during the GEP each calendar year. If you sign up coverage will start the month after you apply

- Annual enrollment period from October 15th to December 7th allows you to make changes to your coverage.

- You can also enroll during a special enrollment period if you retire and lose your employer-sponsored health coverage

You Medicare will go into effect on different dates depending on your enrollment period so make sure to understand when you Medicare plan starts.

Supplemental Medicare Coverage

While Parts A and B provide significant coverage, many people opt for supplemental coverage to help with out-of-pocket costs.

- One option is Medicare Supplement, which is sold by private insurance companies and covers costs like deductibles, copays, and coinsurances under Original Medicare A & B. There are 10 standardized plans in most states with the most popular in the country being Plan F, Plan G and Plan N.

- Another option is Medicare Advantage (or Part C) plans, which combines Parts A and B with additional benefits like prescription drug coverage, dental, vision, and hearing. Medicare Advantage coverage can vary greatly so it’s important to compare your options and choose the coverage that best meets your needs and budget.

Conclusion

Understanding Medicare can be a complex and confusing process, but it’s essential to ensure that you have the coverage you need for your healthcare needs. By understanding the different parts of Medicare, the costs associated with each part, and the key enrollment periods, you can make informed decisions about your coverage. Consider your supplemental coverage options to help reduce your out-of-pocket costs and provide additional benefits to support your health and well-being.

We always recommend speaking to a licensed insurance agent specialized in Medicare. Reach out to CoverRight today to speak with us.