Your personal concierge for navigating Medicare

From learning the basics to enrolling in a plan right for you – CoverRight® is your one-stop-shop.

Your one-stop-shop for navigating medicare

Get a quote

Talk to a licensed insurance agent

Learn about Medicare

How CoverRight works

Step 1

Provide us with some basic information

This takes as little as 2 minutes and allows us to help find you a plan right for you.

Step 2

Learn about Medicare

Browse our site and access online resources to easily learn about Medicare and your options.

Step 3

Book a free call with a licensed insurance agent

Get concierge-style service and free guidance from a licensed insurance agent. Your agent stays with you from beginning to end and there is no obligation to enroll.

CoverRight® provides the tools to help you find a plan that’s right for you

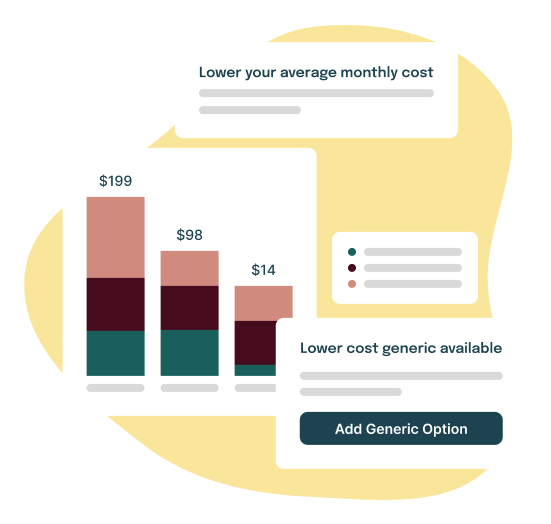

Minimize your drug costs

Don't make the mistake of assuming drug costs are similar across all plans. Costs can sometimes vary significantly. CoverRight will help review your estimated costs which may help you save.

Keep your favorite doctors

Tell us about your doctors. If you have existing doctors that you must have covered, CoverRight® will aim to work to help find plans that cover them in-network.

Maximize your savings and save time

Our goal is to find you Medicare coverage suited to you at an affordable price. At CoverRight®, we’ve helped customers save by helping them shop the market. Our concierge-style service aims to take away the complexity so that you may save hours of research.1

Based on testimonials from CoverRight customers on TrustPilot

Understand your options in one place

Whether it’s Original Medicare or a private Medicare plan, we will recommend the combination of coverage that matches your needs.

Understanding the parts of Medicare

Original Medicare

Part A

Hospital Insurance

Part B

Medical Insurance

Part C

Medicare

Advantage Plans

Part D

Prescription

Drug Plans

Medigap

Medicare

Supplement

Plan Options1:

Option 1

Original Medicare

+ Prescription Drug Plan2

No doctor networks

See any doctor that accepts Medicare

No limit on out-of-pocket costs

May experience higher expenses4 and are responsible for all copays / coinsurances unless you have federal or state assistance

No additional benefits

Standalone plans must be purchased if dental, vision and other coverage are desired.

Get a quote

Option 2

Original Medicare

+ Prescription Drug Plan2

+ Medicare Supplement3

No doctor networks

See any doctor that accepts Medicare

Limited to no out-of-pocket when you buy the most popular options3

Your supplement plan helps pay your out-of-pocket costs, such as deductibles, copays and coinsurance.

Higher Premiums

$90 - $300+ per month for Medicare Supplement5

No additional benefits

Standalone plans must be purchased if dental, vision and other coverage are desired.

Get a quote

Option 3

Medicare Advantage

or ‘Part C’

Doctor networks

In-network providers are preferred to achieve lowest cost share. Some plans may not cover out-of-network care

Pay-as-you-go

Pay copays/coinsurances as you need services until you reach the maximum out-of-pocket limit7

Lower Premiums

66% of plans have $0 premium8

Additional benefits

Majority of plans include dental, vision, hearing and/or prescription drug coverage9

Get a quote

1. These plan combinations reflect the more common combinations of coverage for Medicare beneficiaries that do not have any other retiree health insurance coverage such as employer-sponsored group health insurance program (including Federal Employee Retirement Health Benefits (FEHB)), VA, CHAMPVA or TRICARE coverage

2. Medicare requires beneficiaries to have ‘creditable’ Part D prescription drug coverage in order to avoid late enrollment penalties. A standalone Part D prescription drug plan is required to avoid penalties if you do not have any other ‘creditable’ coverage such drug coverage from a current or former employer or union, VA, CHAMPVA or TRICARE coverage, or individual health insurance coverage

3. Assumes you purchase one of the most popular types of Medicare Supplement plans (Plan F, G or N) which represent 85% of all Medicare Supplement enrollments based on data from the AHIP Center for Policy and Research. If you live in Massachusetts, Minnesota or Wisconsin, Medicare Supplement policies are standardized in a different way to other states

4. Independent research conducted by the Better Medicare Alliance identified that beneficiaries on Original Medicare report higher out of-pocket spending than those on Medicare Advantage (almost $1,598 higher on average)

5. Ranges based on Medicare Supplement price indexes managed by the American Association for Medicare Supplement Insurance on Medicare Supplement pricing across the country

6. In many cases, you’ll need to only use doctors and other providers who are in the plan’s network (for non-emergency care). Some plans offer non-emergency coverage out of network, but typically at a higher cost.

7. All Medicare Advantage plans have a Maximum Out of Pocket Limit (MOOP). You continue to pay copays and coinsurances during a calendar year until you hit the MOOP. In 2026, the MOOP limit for all Medicare Advantage plans for in-networks services is $8,000.

8. Based on research by the Kaiser Family Foundation which found that 66% of Medicare Advantage plans have no premium

9. Based on research by the Kaiser Family Foundation which found that 89% of Medicare Advantage plans include Part D prescription drug coverage and 97% include dental, 99% include vision and 97% include hearing benefits

Excellent

Average rating 4.9 stars

Good experience, saved me money

As quick as allowable and made a complex topic easier....

Bradley Dykes

Pleasant experience

The process was made so easy by the CoverRight representative....

Leslie Boff

I usually do not speak with anyone

I usually do not speak with anyone regarding medicare but...

Dena Kimberlin

Achieve peace of mind with CoverRight

From research and evaluation to enrollment, CoverRight is your personal Medicare concierge service.

We offer plans from:

Alignment Health, Aetna, Allina Health, Anthem Blue Cross and Blue Shield, Anthem Blue Cross, AmeriHealth, Blue Cross Blue Shield of Michigan, Blue Shield of California, Braven Health, CarePlus Health Plans, CareFirst BlueCross BlueShield, Clover Health, Devoted Health, Emblem Health, Excellus Health Plan, Freedom Health, Florida Blue, Guarantee Trust Life, Healthy Blue, Highmark Blue Cross Blue Shield, Horizon Blue Cross Blue Shield of New Jersey, Healthspring, Humana, Independent Health, INA Medicare Supplement, Medical Mutual of Ohio, Molina Healthcare, Mutual of Omaha, MVP Healthcare, Nassau Life Insurance Company, Optimum HealthCare, Peoples Health, Simply, Sentara Medicare, The Cigna Group, UnitedHealthcare®, Univera, UPMC, Wellabe, Wellcare, Wellpoint

195 Broadway

4th Floor

Brooklyn, New York 11211

General Customer Support:

+1 (888) 969-7667 | TTY: 711

Hours:

Mon-Fri 8AM-10PM (ET)

Sat-Sun 9AM-7PM (ET)

CoverRight.com is owned and operated by CoverRight Inc. Insurance agency services are provided by CoverRight Insurance Services Inc.

CoverRight Insurance Services Inc. represents Medicare Advantage HMO, PPO and PFFS organizations that have a Medicare contract. Enrollment depends on the plan’s contract renewal with Medicare.

We do not offer every plan available in your area. Currently we represent 38 organizations across the nation and 3,917 plans across the nation. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Enrollment in a plan may be limited to certain times of the year unless you qualify for a Special Enrollment Period or you are in your Medicare Initial Enrollment Period.

© Copyright 2026. CoverRight Inc. All rights reserved.

MULTIPLAN_COVERRIGHT_2026_HP_M