Medicare can be confusing for many. A 2022 report from Sage Growth Partners found that very few Americans with Medicare are clear about its finer details, while most (63%) said they were overwhelmed by Medicare advertising.

One of the points of confusion with Medicare, especially with retirees, is “excess charges”. This article explains what they are and whether you need to pay for them.

What are Medicare Part B Excess Charges?

Medicare Excess Charges only apply to Medicare beneficiaries who are in the Original Medicare program (not those who enroll in Medicare Advantage plans)

Excess charges are the difference between what a doctor or hospital charges for a healthcare service and the amount Medicare approves for payment.

The total Medicare-approved payment for a specific Medicare-covered service is called an “assignment”.

Medicare Part B excess charges are amounts that a healthcare provider charges beyond what Medicare has approved.

Under the rules, doctors who accepts Medicare can charge up to 15% more than assignment in certain cases and still work with Medicare.

What is Medicare Assignment?

Medicare assignment is an agreement between Medicare and doctors, healthcare providers, and suppliers over the cost of a particular medical procedure under coverage. In other words, it’s an agreement that you will not be charged any more than the amount Medicare has approved amount for a particular treatment.

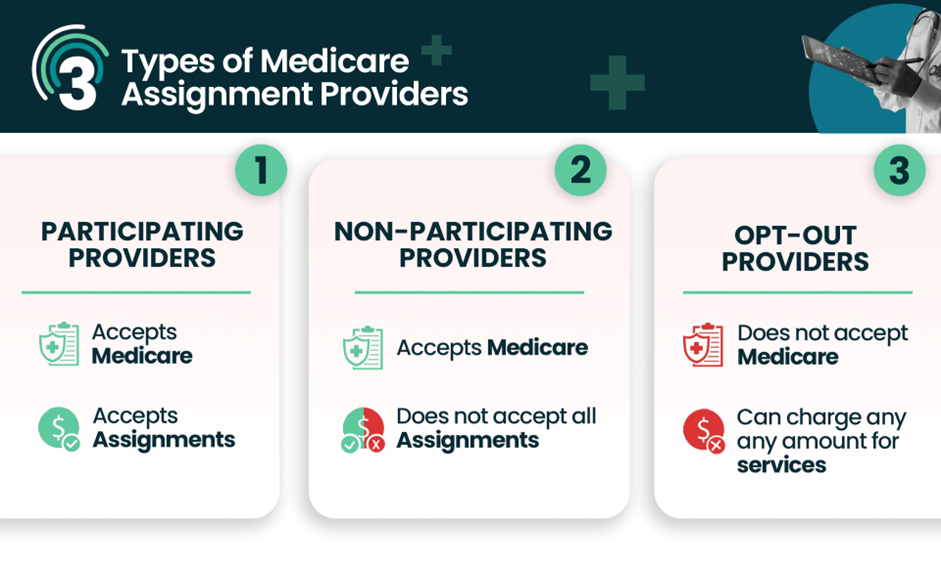

When a doctor or provider accepts Medicare assignment, they are saying they will accept the Medicare-approved amount as full payment. In other words, you are protected from out-of-pocket expenses on covered procedures. These doctors or healthcare providers are known as “Participating Providers”

However, if a doctor accepts Medicare but does not accept assignment you can be liable for up to an additional 15% of the service. These doctors of healthcare providers are known as “Non-Participating Providers”.

If a doctor does not accept Medicare at all, then you will pay the full cost of a service.

How Common Are Part B Excess Charges?

Part B excess charges are exceedingly rare.

The overwhelming majority of doctors and practitioners (98%) were found to have accepted Medicare assignment in 2022, according to US government figures.

That means only 2% of doctors contracted with Medicare were allowed to bill for excess charges. Of that, a significant portion (40%) was from the mental health industry.

How do Medicare Excess Charges Work?

Let’s understand how Medicare Part B excess charges are calculated with the help of an example.

- You visit a doctor for a procedure that Medicare approves for $1,000. The doctor does not accept assignment and charges you the maximum excess charge of 15%, or $150 in this case. This brings the total bill to $1,150.

- If you’ve met your Part B deductible for the year, you’ll be responsible for paying a 20% coinsurance on the $1,000 Medicare-approved payment plus the $150 excess charge.

- That brings your share of the bill to $350 (20% coinsurance of $1000 + $150 excess charge).

How Can You Avoid Excess Charges?

There’s no way to get out of paying excess charges once you’ve been billed. The only way to avoid them is by planning ahead.

Here’s what you can do to avoid paying Medicare excess charges:

- Check the status of Medicare excess charges in your state. Eight (8) US states do not allow excess charges. They are:Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont. All other states are Part B excess states.

- Verify whether your healthcare provider accepts Medicare assignment before receiving a treatment or procedure. If they do, you’ve nothing to worry about. In case they don’t, you can always shop around for another provider who won’t bill you excess charges.

- Buy a Medicare Supplement insurance or Medigap plan, which covers the cost of Part B excess charges as well as deductibles, coinsurance, and copayment. Medigap Plan F and Plan G are the only two policies that cover Medicare excess charges in full.

- Enroll in a Medicare Advantage plan: Medicare Advantage plans have their own rules and agreements with each provider, meaning your do not have to pay “excess charges”, just the copay that is defined in the plan. That means you will be protected from paying excess charges.

Get Personalized Medicare Advice

The intricacies of Medicare coverage can be difficult to grasp for many. That is why we at CoverRight believe in offering personalized Medicare advice with complete transparency.

Our simple online tools help you find out which Medicare plan works best for you in minutes. Shop around for the best option with quotes from multiple leading insurance brands. All this with unlimited support from a licensed insurance agent.

Trust CoverRight to find the perfect Medicare plan today!