ACE Medicare Supplement, a division of ACE Property & Casualty Insurance Company and a subsidiary of Chubb Corporation, offers a range of Medigap plans designed to supplement Original Medicare. As a trusted name in the insurance world, ACE provides coverage to help seniors manage out-of-pocket costs, including deductibles, copayments, and coinsurance.

This article dives into ACE Medicare Supplement plans, highlighting their unique features, state availability, and how they compare to other top Medigap carriers.

Coverage Highlights of ACE Medicare Supplement Plans

ACE Medicare Supplement plans provide coverage for the following:

| Coverage Category | Description |

| Hospitalization Costs | Covers Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. |

| Outpatient Services | Covers Part B coinsurance or copayments for doctor visits, preventive care, and outpatient services. |

| Skilled Nursing Facility Care | Pays for coinsurance required under Medicare Part A for extended skilled nursing care. |

| Part A Deductible | Covers the Part A deductible for hospitalization. |

| Excess Charges | Covers charges above Medicare-approved amounts for Part B services (available in Plan G). |

| Blood Transfusions | Covers the first three pints of blood required for a medical procedure. |

| Hospice Care | Pays coinsurance or copayments for hospice care services. |

Types of ACE Medicare Supplement Plans

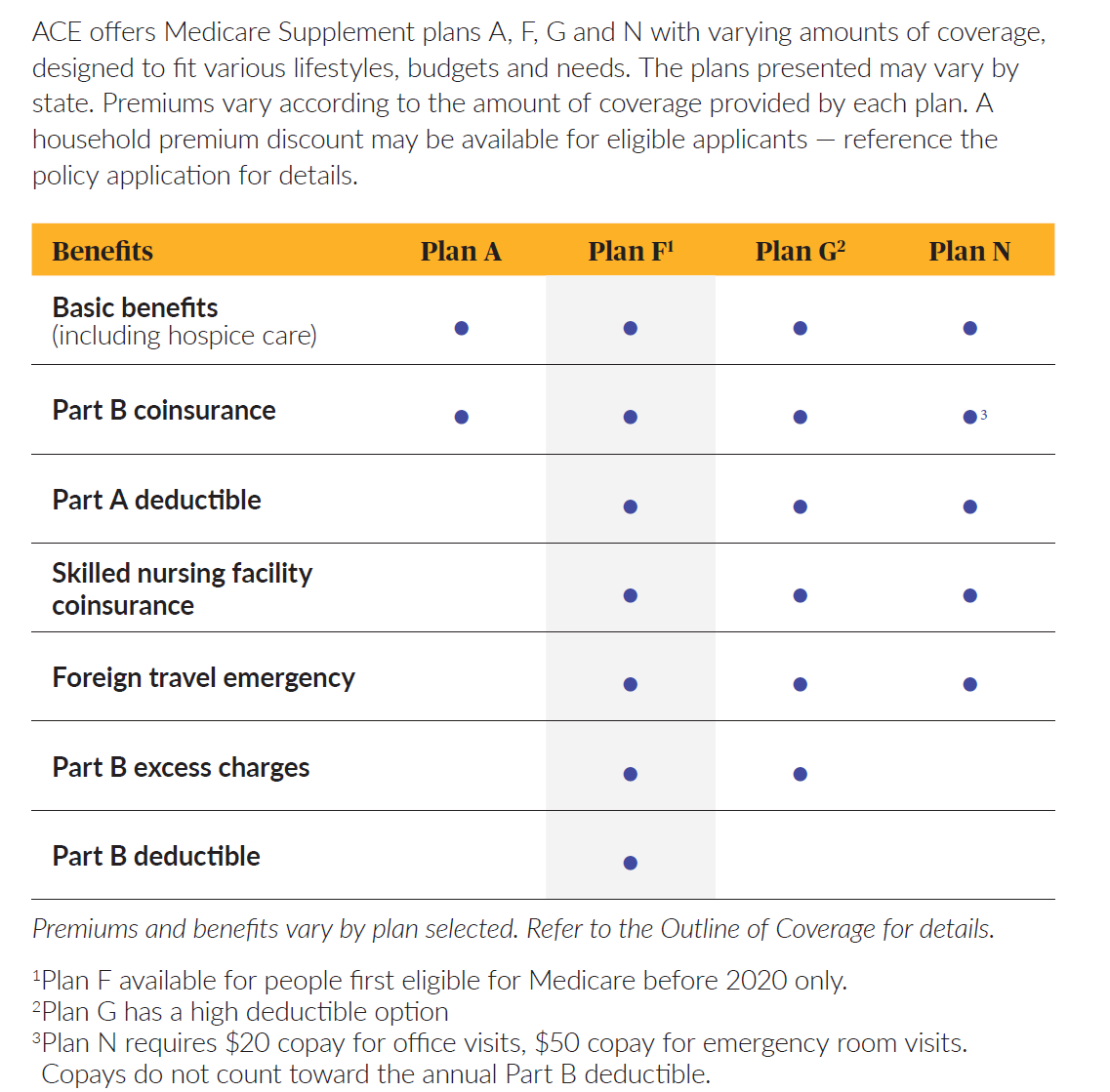

ACE offers several standardized Medigap plans, including popular options like Plan F, Plan G, and Plan N. These plans address different healthcare needs and budgets and cover costs not included in Original Medicare.

- Plan F: Comprehensive coverage, including the Part B deductible. Only available to beneficiaries eligible for Medicare before January 1, 2020.

- Plan G: Offers similar coverage to Plan F but does not include the Part B deductible. It is ideal for those seeking robust protection.

- Plan N: Lower premiums with cost-sharing features, such as copayments for doctor and emergency room visits.

The specific plans available may vary depending on your state of residence. Always check with ACE or a licensed agent for details tailored to your location.

Unique Features of ACE Medicare Supplement Plans

ACE stands out with features that enhance the value of its Medigap offerings:

- A++ Rating: Awarded by A.M. Best, ACE’s superior rating assures customers of financial stability and reliability.

- Household Discounts: Depending on state guidelines, eligible policyholders can receive up to a 7% discount on their premiums.

- Extensive Provider Network: ACE plans allow beneficiaries to see any healthcare provider who accepts Medicare, ensuring flexibility and convenience.

States Where ACE Medicare Supplement Plans Can Be Purchased

ACE Medicare Supplement plans are available in most states, but coverage and pricing may vary depending on where you live.

States where ACE Supplement plans are available include:

- Arkansas, Arizona, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, West Virginia and Wisconsin

States with higher healthcare expenses may have higher premiums for Medigap plans. ACE uses three rating methods to determine premiums:

- Community-rated: Premiums remain the same for all policyholders in a given area.

- Issue-age-rated: Premiums are based on the age of enrollment.

- Attained-age-rated: Premiums increase as the policyholder ages.

Learn more: Medicare Supplement (Medigap): Comprehensive Guide

ACE Medicare Supplement Ratings

ACE Property & Casualty Insurance Company and Chubb have received some of the highest ratings from independent rating agencies. The company has received the following:

- A++ (Superior) rating from A.M. rating (as of April 2024)

- AA (Very Strong) rating from S\&P (as of April 2024)

- Aa3 (Prime-1) rating from Moody’s (as of April 2024)

- AA (Very Strong) rating from Fitch (as of April 2024)

Comparing ACE Medicare Supplement Plans to Other Carriers

ACE competes with top carriers like Aetna and Humana by offering:

- Superior Ratings: ACE’s A++ rating is higher than most competitors.

- Household Discounts: Not all carriers offer these discounts, making ACE a cost-effective choice for families.

- Comprehensive Coverage Options: ACE offers Plans F, G, and N, aligning with market demand for popular Medigap plans.

Underwriting Guidelines

ACE’s underwriting process is straightforward and comparable to other Medigap carriers. However, applicants applying outside their Medigap Open Enrollment Period may need to undergo medical underwriting.

ACE evaluates health conditions to determine eligibility and premium rates but maintains competitive standards to ensure accessibility.

How to Purchase ACE Medicare Supplement Plans through CoverRight

CoverRight simplifies the process of finding the right ACE Medicare Supplement plan. Here’s how:

- Visit the CoverRight website and enter your ZIP code.

- Provide basic information about your healthcare needs.

- Consult with a licensed agent for personalized plan recommendations.

Household Discounts Available with ACE Medicare Supplement Plans

ACE offers a household discount of up to 7% on your monthly premium. Eligibility criteria vary by state, so checking with ACE or an authorized agent is important to see if you qualify for the discount.

ACE Medicare Supplement plans offer a compelling mix of comprehensive coverage, competitive pricing, and unique benefits like household discounts. With superior ratings and a trusted reputation, ACE is a top choice for those seeking Medigap coverage.

Whether you prioritize financial stability, broad provider access, or cost-saving discounts, ACE delivers peace of mind for Medicare beneficiaries.

Sources

- Centers for Medicare & Medicaid Services

- Medicare Supplement Standards. Published 2024. Last Accessed December 13th, 2024.

- Chubb Insurance

- ACE Medicare Supplement Overview. Published 2024. Last Accessed December 13th, 2024.

- Kaiser Family Foundation

- Medigap Plan Comparisons and Costs. Published 2024. Last Accessed December 13th, 2024.