Medicare Supplement plans are popular as they help cover your out of pocket costs that you otherwise might owe under Original Medicare and give you the flexibility to see any doctor in the country that accepts Medicare, giving you maximum doctor coverage relative to say a Medicare Advantage plan.

However, the comprehensive nature of some Medicare Supplement plans can get expensive. In today’s post, we’ll explore Medicare Supplement Plan N – a more affordable Medigap option – and whether it might be right for you.

The Big Picture on Medicare Costs

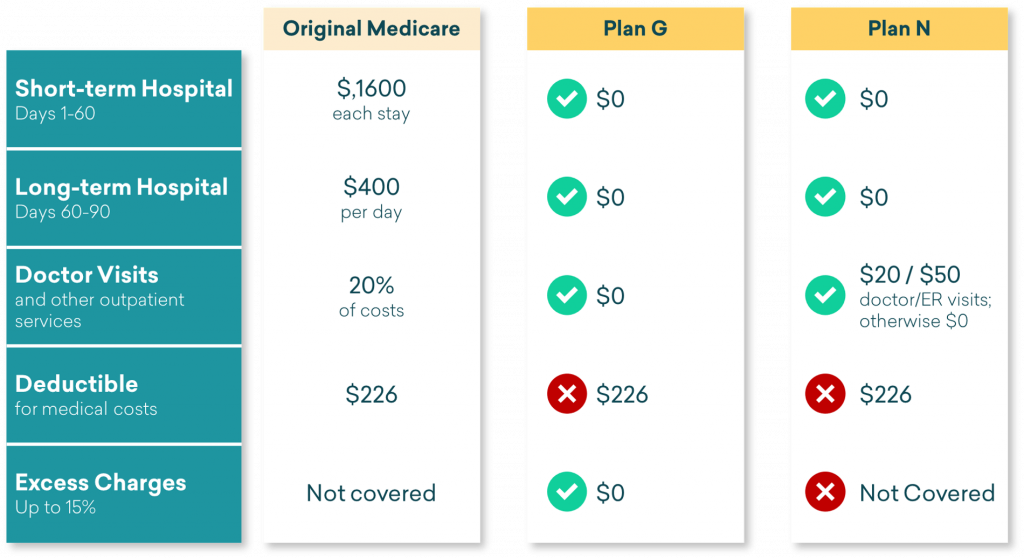

While default government program Original Medicare provides coverage for a wide range of healthcare services, it does not cover all of the costs associated with medical and health care. In particular, the most common cost not covered is a 20% coinsurance that you have to pay for all outpatient medical services (for example: if a health service costs $1,000 you have to pay 20% or $200).

That is why many Medicare participants choose to buy a Medicare Supplement Plan, also known as a Medigap Plan. These are Medicare insurance policies that are sold by private insurance companies to cover expenses, or “gaps,” that are not part of customers’ Medicare coverage.

In total, there are 10 Medigap plans available: Plans A, B, C, D, F, G, K, L, M, and N. Medicare supplement plans are standardized, which means that each plan type offers coverage for a standardized list of basics. However, each plan type adds coverage beyond the basic Original Medicare services, and that is where the differences lie. As you might guess, you pay more if you are receiving more benefits and coverage.

What Is Medicare Part N?

If you search Medicare.gov, you will see that there is no official “Part N” of government-issued Medicare. However, with some additional research you will find that private insurance companies offer “Plan N” coverage as part of their Medicare Supplement plans available. “Part” and “Plan” are mistakenly interchanged a lot but you should be aware that when you talk about “Plan A, B, C, D etc,.” that is different to Medicare “Part A & B” which refers to the default government program.

Plan N is typically considered the more affordable option relative it’s more comprehensive cousins Medicare Supplement Plan F (which is no longer available to newly eligible Medicare beneficiaries) and Plan G.

Medigap Plan N provides a good balance of comprehensive nationwide coverage at a lower premium while delivering the same catastrophic coverage benefits of Plan F & G.

What Are the Pros and Cons of Medicare Supplement Plan N Coverage?

The Pros of Medigap Plan N:

- Can you enjoy lower premiums relative to Plan F & G (the two most comprehensive plans)

- Your key Medicare cost are covered including the most important catastrophic costs (being hospital and medical costs)

- Can you enjoy access to any doctor nationwide that accept Medicare

The Cons of Medigap Plan N:

- In return for a lower premium, you will have some small copays for doctor visits (up to $20) and emergency room visits (up to $50)

- You will still need to pay the Part B Deductible each year before insurance kicks in

- If you don’t use health services you still need to pay the premium each month

- You may be charged a medical or ‘Part B Excess Charge’ by your doctor. This is an amount a doctor can charge above the Medicare-determined standard rate (also known as ‘assignment’) for a service. Doctors who don’t accept assignment can charge up to 15% above the assignment rate that you be responsible for for under Plan N. However, this is uncommon as 98% of Medicare doctors, physicians and other providers accepted Medicare assignment.

Learn more: Medigap Plan N vs Plan G

In Conclusion

Depending on your health concerns and the kind of care you are currently receiving (or would like to receive), a Medicare Supplement/Medigap Plan that offers a Plan N option could be either a great option for you or not.

How can you tell? We recommend you speak with a CoverRight Licensed Insurance Agent who can answer your questions in about 30 minutes. Why not schedule a call now?