Medicare is confusing. But in today’s post, we will demystify confusion about Medicare Supplement (‘Medigap’) Plan G. The alphabet soup of Medicare is arguably one of the more complex subjects you will encounter when signing up for coverage.

Before playing at Visa online casino, take care of your health

Visa Casino’s popularity in Australia is unparalleled, primarily due to its secure, reliable, and user-friendly nature. Australian online casino players frequently choose Visa for their transactions, valuing the seamless experience it offers for both deposits and withdrawals. For an updated and comprehensive list of the top Visa Casinos in 2024, players can turn to casinoau10.com. This website offers a detailed visa casino 2024 rating, serving as an essential guide for players looking to access reputable and high-quality online casinos that accept Visa in Australia. The ratings are carefully curated to ensure reliability and quality, making casinoau10.com an invaluable resource for Australian online gamblers.If You Want to Stop Reading Now and Call Us, We Can Make It Even Easier for You

If you want to explore more, we invite you to read the rest of today’s article.

Let’s Stir Up that Alphabet Soup of Choices

There are 10 standardized Medicare supplement insurance plans, also known as Medigap plans, available in most states. These plans are labeled with letters A, B, C, D, F, G, K, L, M, and N. The benefits covered by each plan are standardized by the federal government, so if you purchase a plan, the coverage will be the same regardless of which insurance company you buy it from.

Here is a brief overview of the benefits covered by each plan:

- Plan A: Covers basic benefits, including Medicare Part A and Part B coinsurance, copayments, and hospice care coinsurance.

- Plan B: Covers the same benefits as Plan A, plus the Medicare Part A deductible.

- Plan C: Covers the same benefits as Plan B, plus coverage for skilled nursing facility care, Medicare Part B excess charges, and foreign travel emergency care.

- Plan D: Covers the same benefits as Plan A, plus the Medicare Part A deductible and skilled nursing facility care coinsurance.

- Plan F: Covers the same benefits as Plan C, but with the added benefit of covering the Medicare Part B deductible.

- Plan G: Covers the same benefits as Plan F, but does not cover the Medicare Part B deductible.

- Plan K: Covers 50% of Medicare Part A coinsurance and hospice care coinsurance, as well as 50% of the first three pints of blood each year. It also covers 50% of Medicare Part B coinsurance and copayments.

- Plan L: Covers 75% of Medicare Part A coinsurance and hospice care coinsurance, as well as 75% of the first three pints of blood each year. It also covers 75% of Medicare Part B coinsurance and copayments.

- Plan M: Covers the same benefits as Plan D, but with the added benefit of covering 50% of the Medicare Part A deductible.

- Plan N: Covers the same benefits as Plan D, but with the added benefit of covering some of the Medicare Part B coinsurance and copayments, as well as a copayment for emergency room visits that don’t result in an inpatient admission.

It’s important to note that not all Medigap plans are available in every state, and the availability and cost of plans may vary depending on where you live. Additionally, you must have Original Medicare (Part A and Part B) to be eligible for a Medigap plan.

Why Do These Medicare Supplement Plan Options Exist?

Why would you consider adding one of these additional categories of coverage?

The simple reason is that traditional Medicare (Parts A and B) doesn’t fully cover all the services you might want or need, which results in “gaps” that additional policies like Medigap and Medicare supplement coverage can fill.

Note that you must obtain these forms of coverage through a private insurance company (not from Medicare.gov). You will buy these additional forms of coverage when you purchase one of their Medigap or Medicare Supplement policies.

What Plan G Offers You

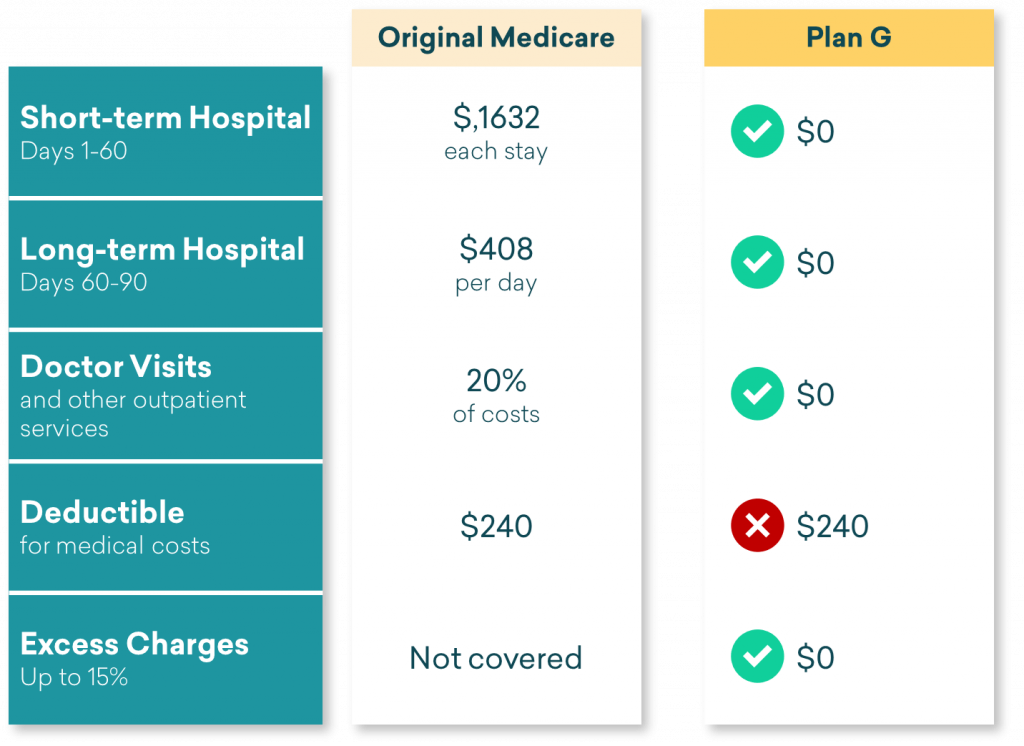

Plan G covers everything that Medicare Part A covers at 100% except for the Part B deductible, which is $240 in 2024. That means that you won’t pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Like Medigap Plan F, Plan G also covers “excess” charges.” Doctors who don’t accept the full Medicare-approved amount as full payment can charge you up to 15% more than the Medicare-approved amount for services or procedures. This is known as the “excess charge.” Most doctors accept Medicare-approved payments and cannot bill you the extra amount. But if they add on 15%, Plan G will pay for it.

Note that Medicare Parts C, D, F, G, M, and N can cover the cost of emergencies that arise when you are not in the United States or its territories. In general, this emergency coverage will pay up to $50,000 in expenses after you pay a $240 deductible. Read your policy or ask your CoverRight Agent for the details.

What Does Plan G Typically Cost?

The average Medigap Plan G premium in 2024 is $145 per month. The only benefit not covered by Plan G — the annual Medicare Part B deductible — costs $240 per year in 2024.

Because Plan G is offered through private insurers, the prices vary based on where you live. Talk to a CoverRight Medicare Concierge to get the exact costs for your situation.

Since the plans are all standardized by Medicare you’re basically shopping by price once you decide on Plan G as your Medicare option.

When Can You Enroll?

Let’s review the basics. You must be in Original Medicare in order to purchase a Medigap plan. You can enroll/re-enroll into Original Medicare during one of these periods:

- Initial Enrollment Period – Most people can first enroll in Medicare (Part A, B, C and D) during a 7-month window: 3 months before the month you turn 65, the month you turn 65, and three months after the month you turn 65.

- Medicare Annual Enrollment Period (AEP) – Between October 15 and December 7 every year, existing Medicare beneficiaries can use this period to re-evaluate and make changes to their Medicare coverage. You cannot use AEP to enroll in Part A and/or Part B for the first time. If you enroll in a plan during AEP, coverage starts on January 1 of the following year.

- Special Enrollment Period (SEP) – You may qualify for a special period the enroll in Medicare based on certain life events such as you change residence or lose current coverage. Depending on your circumstance, you generally will have two full months to enroll.

- Medicare General Enrollment Period (GEP) – January 1 to March 31, every year. Most people will enroll in Medicare Part B coverage when they first sign up for Medicare. GEP is reserved for individuals who chose not to enroll in Part B when they were first eligible. Coverage starts July 1 of the same year.

- Medicare Advantage Open Enrollment Period (MA-OEP) – January 1 to March 31, every year. MA-OEP is only for people who are enrolled in a Medicare Advantage plan as of January 1. During MA-OEP, you can switch to a different Medicare Advantage plan with or without drug coverage, or switch back to Original Medicare and also join a standalone Medicare Prescription Drug plan and purchase a Medicare Supplement plan.

What Are the Pros and Cons of Supplemental Plan G Coverage?

The Pros Include . . .

- Medicare Plan G covers all of the same services covered by Medicare Part A and Part B, with the exception of the Part B deductible ($240). It covers all the gaps in original Medicare.

- Medicare Plan G includes coverage for hospital stays (Part A) and all preventive services like the physician visits that are covered by Part B, without out-of-pocket expenses once the part B deductible is met.

- Most people who purchase Medicare Plan G coverage save money on out-of-pocket costs compared to other Medicare plans. But bear in mind that in exchange, you will pay a monthly premium.

- Medicare Plan G offers no co-pays for Medicare-covered services or any deductible for Part B services.

- You can get care from any physician or other caregiver or hospital specialist who accepts Medicare.

The Cons Include . . .

- Medicare Plan G plans can be more expensive than Medicare Advantage Plans if you compare upfront premiums payments.

- To enroll, you will also have to sign up for a stand-alone Medicare Part D drug plan.

- You will have to sign up for dental coverage separately.

- If you missed your guaranteed issue window you might be denied Medicare Plan G coverage or charged a higher amount based on your health situation. So be sure to sign up during your IEP if you want to consider this comprehensive coverage option

Want to Make the Best Choice for Medicare Plan G?

CoverRight is on a mission to make the Medicare plan selection process easy to understand. We are here to help you compare Medicare plans and find the one best suited to your specific situation. Try the platform for yourself.

Related Posts

What Can a Licensed Insurance Agent Offer?

What Type of Medicare Plan Is Best for You?

Medicare Advantage vs Medicare Supplement Plans

How Medicare Guaranteed Issue Works