The Medicare Annual Enrollment Period (AEP) runs from October 15 to December 7. This year, significant changes are reshaping the Medicare landscape, particularly in Medicare Advantage (MA) and Part D prescription drug plans. Here’s what you need to know to navigate these changes effectively.

According to recently released data by CMS, the number of traditional Medicare Advantage plans is decreasing. Standalone Part D plans are also shrinking, with a 22% reduction in options compared to 2025. This trend is attributed to financial pressures on insurers, including reduced government reimbursements and increased healthcare costs.

Here is what you need to know this Medicare AEP so that you can be prepared.

Traditional Medicare Advantage Plans Are Shrinking—Here’s What That Means for You

If you’re enrolled in a traditional Medicare Advantage (MA) plan—particularly a Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO)—you might want to pay close attention this year. Major insurers are scaling back their offerings for 2026, and the changes could impact your coverage options and costs.

What’s Changing?

- HMO Plans: Expect a 7% reduction in HMO plans from 2025 to 2026, which translates to approximately 135 fewer options. Compared to 2024, this represents a 14% decline, or about 302 plans.

- PPO Plans: PPO plans are facing even steeper cuts, with a 12% decrease from 2025 to 2026 (around 190 plans) and a 16% drop from 2024 levels (approximately 275 plans).

- Standalone Part D Plans: The standalone Part D prescription drug plans are experiencing the most significant contraction, with a 31% reduction from 2025 to 2026 and a 47% decrease since 2024. This represents nearly half of the available Part D options disappearing in just two years.

Source: CMS Landscape files 2026 – Medicare Plans (excl. Special Needs Plans)

Why Is This Happening?

Several factors are contributing to these reductions:

- Financial Pressures on Insurers: Decreased government reimbursements and rising healthcare costs are prompting insurers to withdraw from less profitable regions and plan types.

- Market Consolidation: Some major carriers, like Elevance Health, are exiting certain markets entirely. For instance, Elevance has withdrawn all Part D plans from the market for 2026, signaling a complete exit from the standalone prescription drug coverage business.

- Increased Focus on Specialized Plans: Insurers are increasingly focusing on Special Needs Plans (SNPs), which cater to individuals with specific health needs, such as chronic conditions or dual eligibility for Medicare and Medicaid. Dual-eligible Special Needs Plans (D-SNPs) will increase 12% (+113 plans) while Chronic Condition Special Needs Plans (C-SNPs) show even more dramatic expansion, growing 46% (+172 plans)

Different States, Different Story

The impact does vary significantly by state and reflects the fact that insurers are seeing different profitability in different markets. Texas will see the largest increase in Medicare Advantage plans with 44 additional offerings in 2026. Missouri (+18 plans) and Florida (+18 plans) also show notable growth. Conversely, Minnesota will experience the largest decrease with 26 fewer plans, followed by New York (-25 plans), Colorado (-24 plans), and Indiana (-24 plans).

The complete withdrawal of some major carriers from certain markets—such as Elevance Health’s exit from Part D plans.

The Cost Shifts to Beneficiaries

Medicare Advantage

The average monthly premium for Medicare Advantage (MA) plans is expected to decrease slightly from $16.40 in 2025 to $14.00 in 2026. Currently, 64% of individual MA/MAPD plans have a $0 premium; this will edge down to 63% in 2026.

The enrollment-weighted average Maximum out-of-pocket (MOOP) is rising from $5,688 in 2025 to $5,950 in 2026, a 5% increase. Based on CMS enrollment data, while 65% of current enrollees will see either no change or a decrease in MOOP, the 35% facing increases will see an average jump of $981. The maximum MOOP in 2026 across all plans for in-network is $9,250.

Part D Drug Coverage

Driven largely by the Inflation Reduction Act’s, the cap on Part D out-of-pocket costs will increase from $2,000 in 2025, rising to $2,100 in 2026. This cap shifts more financial risk to plans, which are responding by raising deductibles. The overall enrollment-weighted average drug deductible is jumping from $308 in 2025 to $417 in 2026—a 35% increase according to Medicare Market Insights.

The share of enrollees with $0 drug deductibles is being cut in half for the second consecutive year. In 2024, 60% of the individual MAPD market had $0 drug deductibles. By 2025, this had fallen to 31%. In 2026, only 14% of enrollees will have $0 drug deductibles.

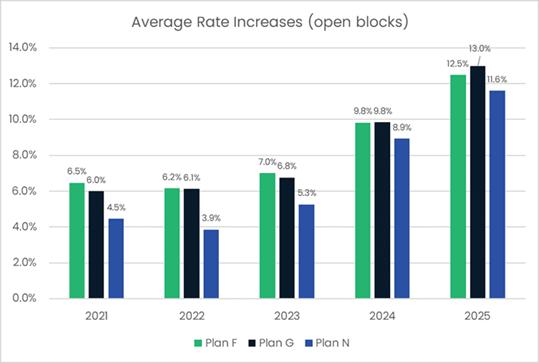

Medicare Supplement

Medicare Supplement premiums are also climbing in 2025. Notably, double-digit hikes are becoming more frequent. This upward trend has been influenced by factors such as increased healthcare utilization and inflationary pressures on medical costs as well as implementation of more guaranteed issue periods where insurers need to issue consumers a plan without medical underwriting.

Source: Medicare Market Insights

What Should You Do This Medicare Open Enrollment?

- Review Your Current Plan: Check your plan’s Annual Notice of Change (ANOC) to understand any modifications to your coverage, premiums, or provider networks.

- Consult Resources: Reach out to your agent, broker or State Health Insurance Assistance Program (SHIP) for guidance on plan comparisons and enrollment.

- Compare Options: Explore other plan options in your area. Given the reductions in traditional plans, it’s crucial to assess whether your current plan will continue to meet your needs.