Medicare Advantage (also known as Medicare Part C) plans cover all the same services that Original Medicare (Part A and Part B) plans do, but they also often include prescription drug coverage and other extra benefits. For this reason, Medicare Advantage plans are a popular selection for Medicare coverage.

In Illinois, residents have many options when it comes to Medicare Advantage plans. With numerous insurance giants in the mix, it is essential to cut through the clutter and pinpoint the providers and plans that best suit individual needs.

Illinois hosts a diverse selection of Medicare Advantage plans from well-known insurance companies. To assist you in this decision-making journey, we’ll focus on streamlining comparisons in key areas such as drug coverage, member experience, and the availability of cost-effective plans. We will also present key plan data for select providers, including monthly premium and out-of-pocket cost information.

Compare Medicare Advantage Providers in Illinois

Before viewing the important statistics of key Medicare Advantage plan providers in Illinois, let’s learn more about some key metrics to consider when selecting a Medicare plan:

CMS Star Rating: Published every year by the Centers for Medicare & Medicaid Services (CMS) to measure the quality of health and drug services received by customers. The overall star rating, between 1 (low) and 5 (high) stars, considers up to 40 quality and performance measures and is a strong point of comparison for plan selection.

Monthly Premium: The amount you would pay to a provider for monthly health insurance plan coverage.

In-Network Max Out-of-Pocket Amount: The maximum amount of money you would pay to a provider for in-network services you received during a coverage period (usually one year).

Note: All statistics in the charts below were calculated using plan data specific to Illinois.

National Providers

| Provider Name | Average CMS Star Rating | Median Monthly Premium | Median In-Network Max Out-of-Pocket $ |

| UnitedHealthcare | 4.1★ | $0.00 | $3,800 |

| Humana | 4.2★ | $0.00 | $5,500 |

| Aetna | 4.0★ | $0.00 | $4,390 |

| Blue Cross and Blue Shield | 2.9★ | $0.00 | $5,900 |

| Wellcare | 2.8★ | $0.00 | $2,900 |

Regional Providers

| Provider Name | Average CMS Star Rating | Median Monthly Premium | Median In-Network Max Out-of-Pocket $ |

| Essence Healthcare | 5.0★ | $0.00 | $2,800 |

| Medica | 4.5★ | $0.00 | $3,900 |

| Quartz Medicare Advantage | 4.5★ | $30.00 | $4,500 |

| HealthPartners UnityPoint Health | 4.5★ | $24.50 | $3,600 |

Please also note that while some smaller providers may offer 5-star or other highly rated CMS rated plans, they will likely have a limited, much smaller network of physicians than the much larger national health insurance providers.

Top-Rated Medicare Advantage Providers in Illinois

Humana

Humana is a massive health insurance company in the United States that offers a diverse range of healthcare insurance and related products, including Medicare.

By market share, they are the second largest provider of Medicare Advantage plans in the United States (17%).

Blue Cross and Blue Shield of Illinois

Blue Cross and Blue Shield of Illinois (“BCBSIL”), a Division of Health Care Service Corporation, is Illinois’ only statewide, customer-owned health insurer. They are the largest provider of health benefits in Illinois, serving more than 8.9 million members in all 102 counties across the state.

Additionally, BCBSIL is the 5th largest Medicare Advantage carrier in Illinois by market share (4%).

Essence Healthcare

Essence Healthcare, wholly owned by Lumeris, is Illinois’ only 5-star Medicare Advantage plan.

The plan was founded in 2003 by a group of St. Louis area doctors and has grown into one of the leading Medicare Advantage plans in Missouri and Illinois (64,000 members as of 2020).

United Healthcare

UnitedHealthcare is a national provider of health insurance and related products. Additionally, they are the market share leader (28.5%) in the competitive Medicare Advantage segment, providing service to over 9 million enrollees nationwide. Similarly, they are also the Medicare Advantage market share leader in Illinois (33%) as well.

Additionally, they are also the fastest-growing MA plan provider, having grown 12.7% year over year in 2023 from 2022 (the second fastest-growing MA provider was Humana, at 10.1%).

Aetna

Aetna is a national provider of health insurance and related products. They operate as a subsidiary of CVS Health Corporation.

As of March 2023, they were the third-largest provider of Medicare plans (10.6% market share) and the largest provider of Medicare prescription drug plans (27.2% market share).

Medica

Founded in 1975, Medica is a non-profit health plan that provides insurance to nearly 1.5 million people. Medica’s network consists of 100,000 providers, 25 care system partners, and 250 community partners. Additionally, Medica services 166,000 Medicare and Medicaid enrollees across 12 states.

Quartz Medicare Advantage

Through its extensive provider network, Quartz focuses on local, community-based health care and services for more than 350,000 customers who live in southern and western Wisconsin, parts of Illinois, Iowa, and Minnesota.

Quartz maintains offices in Madison, Sauk City, and Onalaska, Wisconsin.

HealthPartners UnityPoint Health

When it launched in 2015, HealthPartners UnityPoint Health (“HPUH”) combined the insurance expertise of HealthPartners and the health care experience of UnityPoint Health.

HealthPartners organization offers high quality care across 8 hospitals, 55 primary care clinics, and 20 urgent care locations. Similarly, UnityPoint Health’s robust integrated health system maintains relationships with more than 400 physician clinics and 39 network hospitals. Through their union, they have been able to successfully innovate and grow HPUH’s 4.5-star Medicare plan into a popular option in both Iowa and Illinois.

Wellcare

Wellcare is a large Healthcare enterprise which provides health insurance and related products to Americans nationwide. Medicare Advantage is a key product offering of Wellcare’s – they have a market share of 4.3%.

Additionally, as of 2023, they are the second-largest provider of prescription drug plans (PDPs) (19.9% market share). As with the other large health insurance providers, they have a strong presence in Illinois with deep connections to hospitals, services, and physicians statewide.

How to Choose the Best Medicare Advantage Plan

Choosing the right Medicare Advantage plan, tailored to fit your unique needs, is critical to maintaining a healthy lifestyle. Let’s review the key steps to simplify the decision-making process.

From understanding your healthcare needs to exploring plan specifics, our goal is to empower you with the knowledge necessary to navigate the array of options.

- Assess Your Healthcare Needs: Determine your specific medical needs, including prescription medications, anticipated doctor visits, and any specialized care requirements.

- Review Plan Options: Explore available Medicare Advantage plans in your area, considering coverage, costs, and additional benefits. Check for plans offered by reputable insurance companies.

- Check Network Providers: Confirm that your preferred doctors, hospitals, and healthcare providers are included in the plan’s network to ensure convenient and cost-effective access to care.

- Evaluate Drug Coverage: If you take prescription medications, assess each plan’s formulary to ensure your drugs are covered. Consider copayments, coinsurance, deductibles, and any restrictions.

- Consider Additional Benefits: Medicare Advantage plans often include extra benefits like dental, vision, or wellness programs. Evaluate these perks based on your individual needs.

- Examine Cost Structures: Compare premiums, deductibles, copayments, and coinsurance for each plan. Consider your budget and how these costs align with your expected healthcare usage.

- Check Star Ratings: Refer to Medicare’s Star Ratings for plans. Higher-star-rated plans typically offer better overall quality, customer satisfaction, and healthcare outcomes.

- Understand Plan Rules and Restrictions: Familiarize yourself with the plan’s rules, including any prior authorization requirements or referrals for specialists. Ensure you understand how the plan operates.

- Review Out-of-Pocket Maximums: Identify the plan’s annual out-of-pocket maximum, which limits your spending on covered services. This can provide financial predictability in case of unexpected healthcare expenses.

- Get Personalized Assistance: Reach out to CoverRight for personalized assistance. We can help clarify any doubts and guide you through the enrollment process.

Remember that individual preferences and healthcare needs vary, so the best Medicare Advantage plan for you depends on your own unique circumstances. If you have questions unique to your situation that you would like answered, we recommend scheduling a call to speak with a licensed insurance agent.

Additionally, if you are evaluating your drug coverage, we recommend looking into switching to the generic version of your drugs. If available, the generic version will be much cheaper than the brand-name version.

What Medicare Advantage Plans Cover

Medicare Advantage plans (a.k.a. Medicare Part C plans) are offered by Medicare-approved private insurance companies.

These plans provide all the coverage of Original Medicare (Part A and Part B) and often include additional benefits. Here’s an overview of what Medicare Advantage plans typically cover:

- Hospital Coverage (Part A): This includes inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Medical Coverage (Part B): This covers outpatient care, doctor visits, preventive services, and some home health care.

- Prescription Drug Coverage (Part D): Many Medicare Advantage plans include prescription drug coverage. If not, beneficiaries can usually purchase a standalone Medicare Part D prescription drug plan.

- Additional Benefits: Depending on the exact plan, Medicare Advantage plans can often offer extra benefits not covered by Original Medicare, such as dental care, vision care, hearing aids, fitness programs, and wellness services.

- Out-of-Pocket Maximums: These plans have yearly limits on out-of-pocket costs for medical services, providing financial protection for beneficiaries.

It’s important to note that coverage can vary between different Medicare Advantage plans, so individuals should carefully review plan documents, including the Summary of Benefits, and consider their specific healthcare needs when choosing a plan.

Additionally, beneficiaries must continue to pay their Medicare Part B premium in addition to any premium charged by the Medicare Advantage plan.

When to Enroll for Medicare Advantage Plans in Illinois

Enrollment for Medicare Advantage Plans in Illinois takes place during specific timeframes.

Initial Enrollment occurs when you’re first eligible for Medicare, usually around age 65. The Annual Enrollment Period (AEP) runs from October 15 to December 7 each year, allowing you to switch, drop, or add Medicare Advantage plans.

The Medicare Advantage Open Enrollment Period from January 1 to March 31 permits plan changes or a return to Original Medicare.

Special Enrollment Periods may apply in certain circumstances, such as moving, losing employer coverage, or qualifying for Medicaid. It’s crucial to be aware of these periods to make informed decisions about your Medicare Advantage coverage in Illinois.

Medicare Advantage vs. Medigap

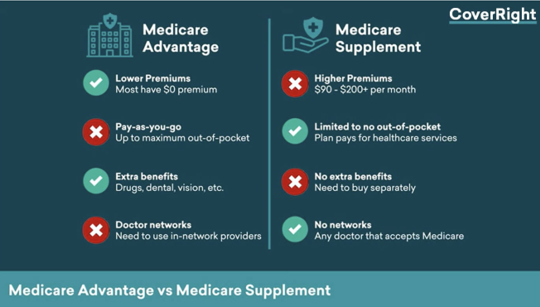

Choosing between Medicare Advantage (Part C) and Medigap (Medicare Supplement) involves being aware of key distinctions between the two categories of plans. Medicare Advantage combines Part A and B benefits, often incorporating extras like prescription drug coverage.

These bundled plans are typically more affordable and administratively convenient despite potentially having some network restrictions.

Overall, Medicare Advantage plans aren’t as popular in Illinois as they are nationwide. As of October 2022, only 38% of Illinois residents with Medicare were enrolled in private Medicare Advantage plans. This figure is lower than the 2022 national average of 46%.

On the other hand, Medigap plans work in tandem with Original Medicare, covering out-of-pocket costs. While offering greater flexibility in healthcare provider choice, Medigap plans generally come with higher premiums.

Here’s a breakdown of the two types of plans:

| Medigap (Medicare Supplement) | Medicare Advantage (Part C) | |

| Coverage | – Comprehensive coverage of out-of-pocket costs. – Greater flexibility in choosing healthcare providers. | – Bundled coverage, often includes prescription drugs and extras. – Limited to network providers; may require referrals. |

| Costs | – Higher premiums but lower out-of-pocket costs. | – Lower premiums, but potential for higher out-of-pocket costs. |

| Prescription Drugs | – Doesn’t typically include prescription drug coverage. | – Often includes prescription drug coverage. |

| Network Restrictions | – No network restrictions; can see any doctor accepting Medicare. | – Limited to network providers; may require referrals. |

| Administration | – Simplifies administrative processes with a single plan. | – Requires managing multiple aspects (Part A, B, and sometimes D). |

| Flexibility | – Freedom to use healthcare services nationwide. | – May be limited to specific geographic regions or networks. |

| Additional Benefits | – Focuses solely on medical costs; no additional benefits. | – May include extra benefits like dental, vision, and wellness programs. |

| Decision Criteria | – Suited for those who prioritize flexibility and are willing to pay higher premiums. | – Attractive for those seeking bundled coverage with potentially lower costs. |

The decision here hinges on your own personal priorities: Medicare Advantage for cost-effective bundled benefits with some network constraints or Medigap for more flexibility in provider selection, albeit at a potentially higher cost.

All Medicare Advantage Providers in Illinois for 2024

- Aetna Medicare

- Blue Cross and Blue Shield of IL, NM

- Blue Cross and Blue Shield of Illinois

- Cigna

- Clear Spring Health

- Devoted Health

- Essence Healthcare

- Health Alliance Medicare

- HealthPartners UnityPoint Health

- Humana

- Medica

- Medical Associates Health Plan

- Molina Healthcare of Illinois

- Quartz Medicare Advantage

- UnitedHealthcare

- Wellcare

- Wellcare by Allwell

- Zing Health