Medicare Supplement, or Medigap, is a type of private insurance designed to supplement Original Medicare (Part A and Part B) by filling the ‘gaps’ in costs that Medicare doesn’t cover. Private insurance companies offer Medicare Supplement plans and help beneficiaries pay out-of-pocket costs such as deductibles, copayments, and coinsurance. Therefore, to make the most of your Medicare coverage, it’s essential to consider whether a Medicare Supplement plan is right for you.

However, Medicare Supplement plans may not be the best choice for everyone. In this article, we will explore the “worst” Medicare Supplement plans.

In total, 10 federally standardized Medigap plans are available in most states: Plans A, B, C, D, F, G, K, L, M, and N, each with a different level of coverage. Other Medigap plans, including Plans E, H, I, and J, are no longer for sale. However, they still offer their original coverage to those who purchased these plans. In addition, Plan F and C are no longer available to anyone who became eligible for Medicare after January 1, 2020 (if you were eligible before this date you can still purchase one of these plans).

Medicare Supplement Plan Comparison Chart

| Benefit | Plan A | Plan B | Plan C | Plan D | Plan F* | Plan G* | Plan K | Plan L | Plan M | Plan N |

|---|---|---|---|---|---|---|---|---|---|---|

| Part A coinsurance and hospital costs up to 365 days after Medicare benefits are used | Y | Y | Y | Y | Y | Y | 50% | 75% | Y | Y |

| Part B coinsurance or copayment | Y | Y | Y | Y | Y | Y | 50% | 75% | Y | Y*** |

| Blood (first 3 pints) | Y | Y | Y | Y | Y | Y | 50% | 75% | Y | Y |

| Part A hospice care coinsurance or copayment | Y | Y | Y | Y | Y | Y | 50% | 75% | Y | Y |

| Skilled nursing facility care coinsurance | — | — | Y | Y | Y | Y | 50% | 75% | Y | Y |

| Part A deductible | — | Y | Y | Y | Y | Y | 50% | 75% | 50% | Y |

| Part B deductible | — | — | Y | — | Y | — | — | — | — | — |

| Part B excess charge | — | — | — | — | Y | Y | — | — | — | — |

| Foreign travel exchange (up to plan limits) | — | — | 80% | 80% | 80% | 80% | — | — | 80% | 80% |

| Out-of-pocket limit** | N/A | N/A | N/A | N/A | N/A | N/A | $7,060 in 2024 | $3,530 in 2024 | N/A | N/A |

Notes: Y = Yes, — = Not Covered

* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,800 in 2025 before your policy pays anything. (Plans C and F aren’t available to newly eligible people for Medicare on or after January 1, 2020.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in inpatient admission.

However, with the wide range of Medicare supplement plans and disparate coverage, how do you identify the worst Medicare supplement plans?

High Monthly Premiums

One common downside with Medicare Supplement plans is that you have to pay an additional premium on top of what you pay to Social Security for your Medicare Part B. This can be prohibitive for some individuals who can’t afford to pay for the coverage. Personal characteristics (i.e., lifestyle, age, gender, tobacco usage) are all factors in calculating a given Medigap plan’s premium.

Medicare Supplement plans are standardized, meaning if you purchase a ‘Plan G’ from Company A, it is exactly the same coverage as a ‘Plan G’ from Company B, therefore, once you have decided on a plan, you are only shopping for:

- Price (Monthly Premium)

- Reputation of the Carrier

Therefore, the worst Medicare Supplement plans are generally those with high monthly premiums for the same “type” of plan, as you pay more for the same coverage.

Stop overpaying for Medigap. Start making Medicare work for you.

CoverRight’s licensed agents simplify Medicare Supplement options, helping you find affordable coverage without the guesswork.

Start with CoverRight today and discover how you can save on Medigap premiums.

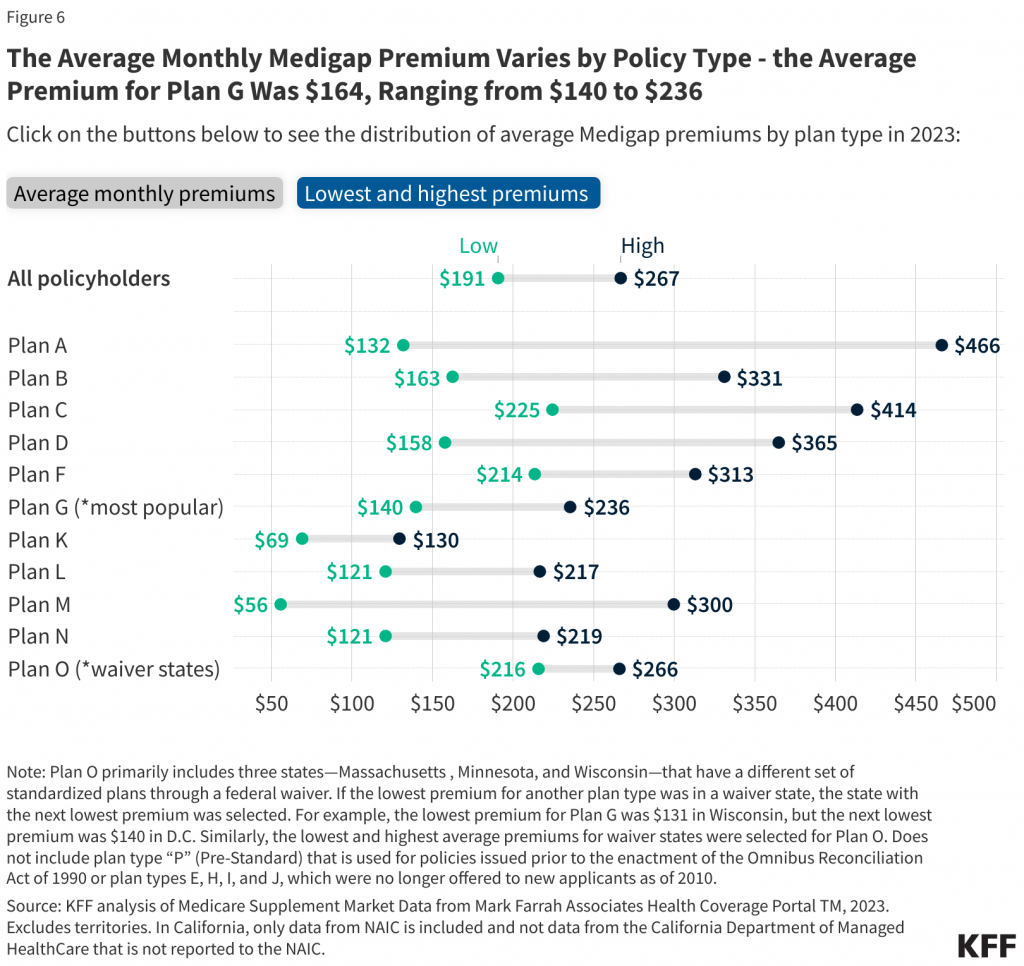

On average, the monthly premium for Plan G is $164, though premiums can range from $140 to $236 depending on factors like age, location, and the insurance provider. The chart below illustrates the range of premiums across different Medigap policy types, providing a snapshot of average costs for beneficiaries.

Regardless of the insurance company you elect to go with, rates will increase yearly—so why not start from the lowest base?

In most cases, premiums will increase by a few percent each year. These rate hikes are due to two factors:

- insurance companies determine the rate based on the age of the member when they start the policy; rates are lower for younger individuals and increase as we age

- insurance companies usually add on another 2% to 4% due

Average Medigap Premium Increase Chart

| 65 Year Old | 80 Year Old | % Increase |

| $131.30 | $208.79 | 59.02% |

| $129.86 | $190.84 | 46.96% |

| $134.81 | $217.58 | 61.40% |

| $166.08 | $289.13 | 74.09% |

| $145.75 | $217.82 | 49.45% |

Lack of Hospital Deductible Coverage

When debating which Medigap plan to enroll in, it is critical to identify plans that do not cover hospital deductibles. Hospital stays can be extremely costly and painful without sufficient Medigap plan coverage.

In this vein, some of the worst Medicare supplement plans include Medigap Plan A, which does not cover the Medicare hospital deductible of $1,632 in 2024. This deductible applies to each “benefit period.” In other words, if your plan does not cover it, you must pay this amount every time you visit the hospital.

| Benefit | 65-74 years old | 75-84 years old | 85+ years old |

| Mean length of stay, days | 5.3 | 5.6 | 5.6 |

| Mean hospital costs | $12,400 | $11,400 | $9,400 |

Generally, it is not worthwhile purchasing Plan A and B as these basic plans have limited members. You will often find that the price of these “basic” plans may have a higher monthly premium then plans with more coverage simply because there are not enough people signing up.

In many cases, if you are considering Plan A or B, we would recommend enrolling in a Medicare Advantage plan instead.

Less than Full Payment for Covered Services

While Medigap Plan K and Plan L are the only two Medicare supplement plans with out-of-pocket limits, they also do not pay for 100% of the services they cover.

For example, these plans will 1) only cover up to 50% of both your Part A deductible and Part B coinsurance or copayment, and 2) will not cover Medicare Part B excess charges. For most people, this lack of full payment overwhelms any potential benefits from out-of-pocket limits.

For this reason, Plan K is only relevant for people who are aging into Medicare, are accustomed to having employer coverage, have out-of-pocket expenses, and live in states that don’t allow excess charges. Plan L may pay a bit more (~75%) than Plan K on certain Medigap benefits (i.e., Part B coinsurance/copayment), but it is still only ideal for persons who live in states that don’t allow excess charges.

We don’t want to understate the importance of avoiding Part B excess charges: while not common, unless you are in a state where this type of charge is banned, nonparticipating providers that accept Medicare can charge you up to 15% more than Medicare’s amount for applicable services.

Additionally, when you use non-participating providers:

- You may be expected to pay the whole charge upfront and wait until Medicare pays your provider to be reimbursed.

- Your provider is supposed to submit your claim to Medicare and isn’t allowed to charge you for doing so.

It’s generally best to avoid Plan K or L and select a Medigap plan that pays in full for covered services.

Financial Stability & Reputation of Insurance Carrier

Like all insurance plans, it’s important to review carriers’ financial stability and credibility when considering the worst Medicare Supplement plan. Here is a table of the financial stability rating of the nation’s top Medigap insurance companies.

| Insurance Carrier | AM Best Rating |

| ACE Medicare Supplement | A++ |

| Aetna | A |

| Accendo | A |

| AllState | A+ |

| Anthem | A |

| Cigna | A |

| Guarantee Trust Life | A- |

| Humana | A |

| Lumico | A |

| Mutual of Omaha | A+ |

| Nassau Life | B++ |

| UnitedHealthcare | A+ |

| Wellabe | A |

Best Medicare Supplement Plans

So you may be asking, what are the “Best” Medicare Supplement plans available instead of the worst Medicare Supplement plans?

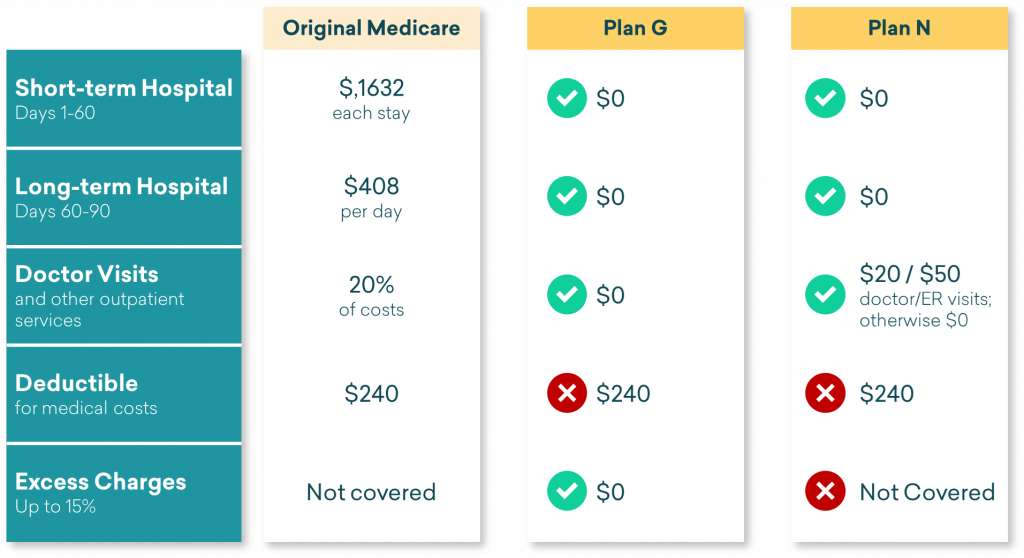

Those looking at Medigap plans should consider Plan G and Plan N.

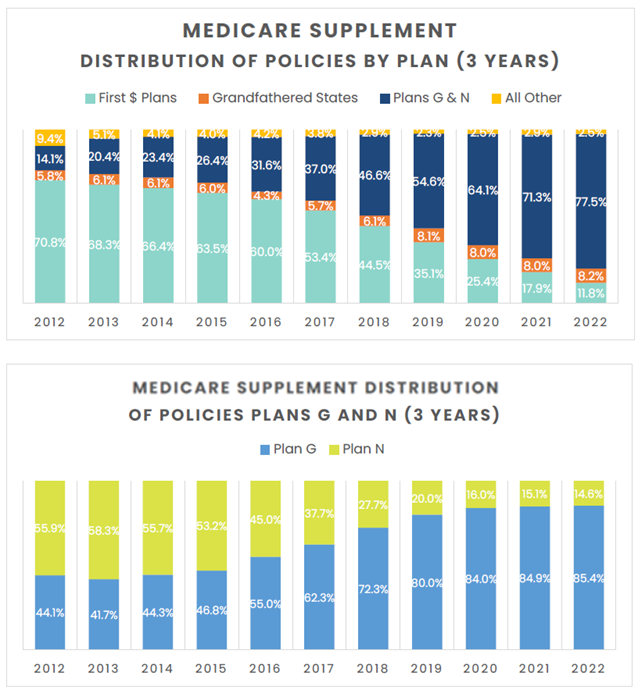

These plans the most comprehensive for those who are newly eligible for Medicare and now make up close to ~80% of all new Medigap purchases according to Telos Actuarial.

Distribution of Medicare Supplement Enrollment Table

| Plan Type | % of Total Medicare Supplement Enrollees |

| Plan F | 46% (No longer available for newly-eligible Medicare beneficiaries) |

| Plan G | 27% |

| Plan N | 10% |

| Plan C | 4% (No longer available for newly-eligible Medicare beneficiaries) |

| Plan I | 2% |

| Plan A | 1% |

| Plan B | 1% |

| Plan D | 1% |

| Plan K | 1% |

| Plan L | <0.5% |

| Plan M | <0.5% |

| Other | 6% |

Frequently Asked Questions

What is the enrollment process for Medigap plans?

- Enroll in Original Medicare (Part A and Part B)

- Compare Medicare Supplement plans sold in your state

- Select the plan that meets your needs

- Let the licensed Medicare experts at CoverRight work with you to fill out and submit an application.

You can apply for a Medicare Supplement plan anytime so long as you have Medicare Part A and Part B. However, please note that if it’s after your Medigap Open Enrollment Period, the insurance company can look at your medical history and ask questions about your health conditions. The company can charge you more, or even reject you, if you have a health problem. This process is known as medical underwriting.

Can I switch from one Medicare supplement plan to another?

Yes, you can switch at any time. However, if you are outside a period where you have “guaranteed-issue rights,” you will need to answer questions about your health and subject yourself to the medical underwriting process. During this process, the insurance provider will review your application and may accept or reject it based on their review of your profile and your answers to personal health questions.

If you are in a period where you have “guaranteed-issue rights,” however, the insurance company that sells the Medicare Supplement plan:

- Must cover all of your pre-existing conditions

- Note that despite this, in some cases, you might have to wait up to six months before those conditions are covered

- Cannot require medical underwriting

- Cannot charge you more for your policy because of health reasons

- Cannot deny you coverage

“Guaranteed-issue rights” are Medigap protections that give you the right to enroll in any Medicare Supplement plan offered by any insurance company in your state, regardless of your health status.

How does Medicare Supplement plan pricing work?

Insurance companies can decide the monthly premium costs for their Medicare Supplement insurance plans.

They can use any of the three ways to set premium costs:

- Community rating: In this method, the plan premium is priced so that everyone who buys the same Medicare Supplement insurance plan pays the same monthly premium. Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age.

- Issue-age rating: The premium you pay is based on your age when you buy the plan (i.e., plan is cheaper if you buy it at 65 versus if you wait until you are 70). Over time, premiums may increase because of inflation and other factors, but they won’t increase because of your age once you’ve bought the plan.

- Attained-age rating: The premium you pay is based on your current age. Younger buyers may find Medicare Supplement insurance plans rated this way very affordable. Over time, however, these plans may become very expensive because your premiums increase as you age. Inflation may also affect the price of plans that are priced using the attained-age rating.

When shopping for a Medicare Supplement insurance plan, you should ask insurance companies what rating system they use to price their plans’ premiums.

Your health deserves the right plan.

Don’t navigate Medicare alone—let CoverRight’s Medicare experts guide you to a Medigap plan that fits your budget and needs.

Schedule a free call with CoverRight now for personalized assistance and secure peace of mind in your healthcare coverage.